Remodeling Impact Report: Projects That Bring Joy & ROI

Is your home ready for a refresh? Whether it’s for their own enjoyment or to prep their houses for sale, Americans are investing more and more money into remodeling each year. According to a recent report by the National Association of REALTORS® (NAR), the demand for top-condition homes is going up among buyers as well. So which projects will get you the most bang for your buck? Or, perhaps more importantly, which projects will bring you the most joy? Here’s what the Remodeling Impact Report revealed…

Projects That Boost Your Happiness

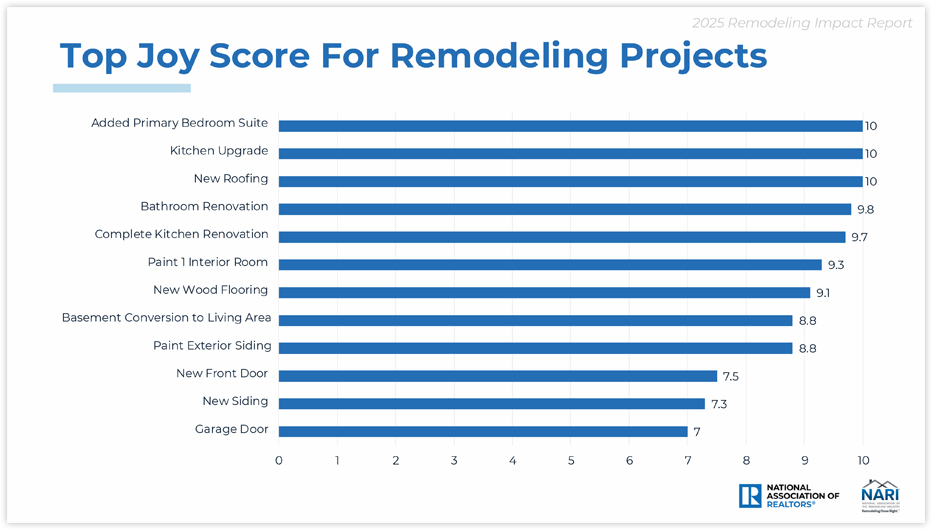

It’s easy to think about improvements in terms of monetary value…but what about the value of enjoyment and enhanced livability? As part of their report, NAR calculated a “Joy Score” for common remodeling projects based on the happiness homeowners reported with their renovations. Three projects stood out with perfect joy scores: adding a primary bedroom suite, upgrading the kitchen, and replacing roofing. Here are the projects with the highest joy scores:

Projects That Help Pay for Themselves

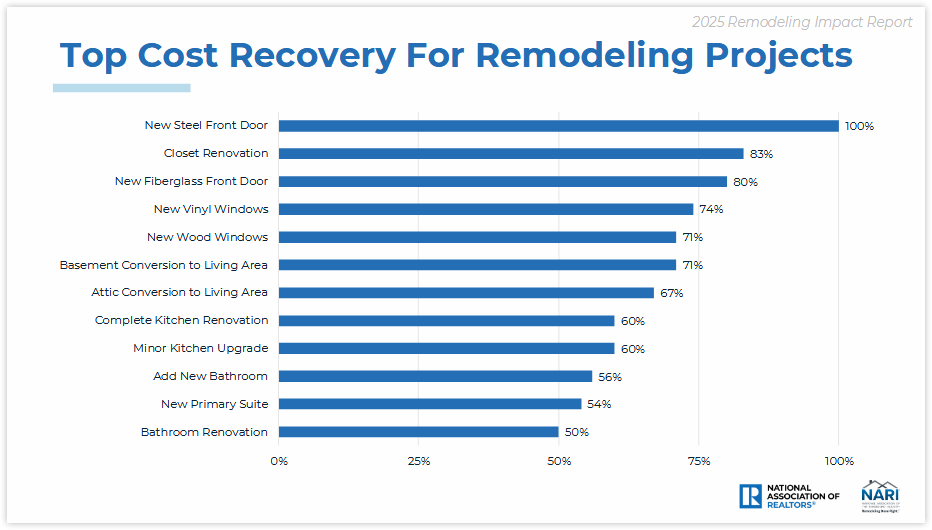

As a bonus to bringing you joy, many projects will also pay you back for at least a portion of their cost when it’s time to sell your home. Projects that increase your home’s curb appeal tend to bring you the highest return on investment (ROI), although closet renovation snuck in as a surprise gem:

What If You’re Remodeling to Sell?

In virtually any real estate market, a home that feels fresh, clean, modern, and move-in ready will always sell faster and for more money than its dated counterpart. This isn’t always tangible in the ROI studies but, as agents, we see it every day. The good news is that the updates you make to sell are often more cosmetic and less expensive than the upgrades you might make if you were planning to stay in the home forever (pssst…check out this article on remodeling projects you should avoid if you’re selling your home).

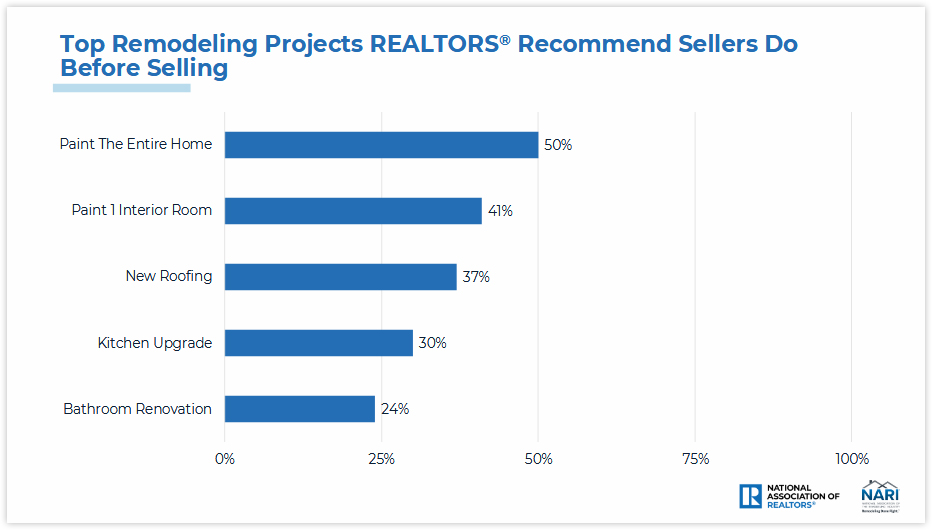

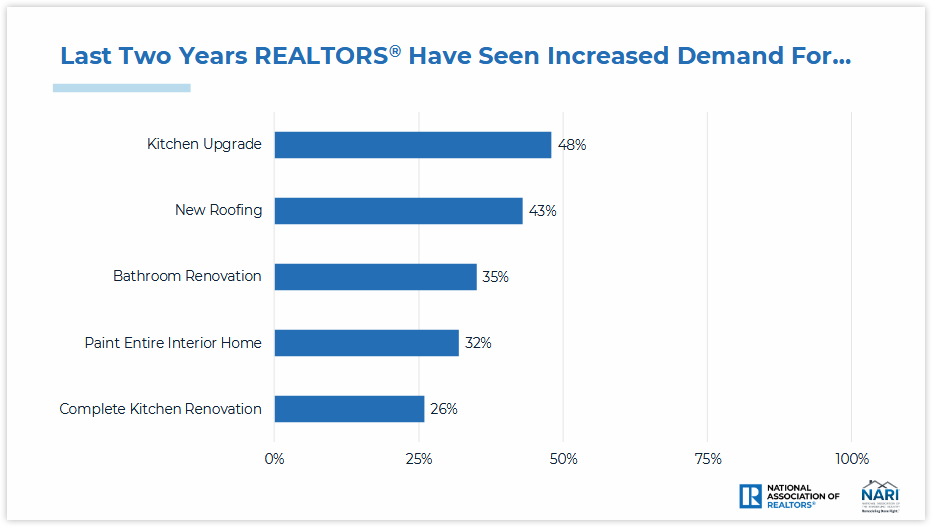

The two charts below show both the projects REALTORS® most often recommend sellers do before selling, and five projects we’ve seen increased demand for from buyers:

It’s critical to understand that every home, neighborhood, and situation is different. Your home’s unique characteristics and your personal goals as a homeowner will have more impact on which remodeling projects are best for you than any of these general trends. If you’re remodeling to sell, reach out for advice; I’m happy to help you choose the right projects—and avoid the wrong ones—to help you accomplish your objectives.

Data & charts copyright ©2025 “2025 Remodeling Impact Report.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. April 9, 2025, https://www.nar.realtor/sites/default/files/2025-04/2025-remodeling-impact-report_04-09-2025.pdf.

© Copyright 2025, Windermere Real Estate/Mercer Island.

Remodeling Projects to Avoid When Selling Your Home

It’s common for homeowners to feel compelled to remodel their homes before they sell. Renovating the spaces in your home can increase its value and help you compete with comparable listings in your area. However, some remodeling projects are more beneficial than others as you get ready to hit the market. Always talk to myself or another local agent to determine which projects are most appealing to buyers in your area.

When preparing to sell your home, you want to strike the right balance of upgrades. Making repairs and executing renovations will attract buyer interest, but you don’t want to dump so much cash into remodeling that you won’t be able to recoup those expenses when your home sells.

So, how do you know where to focus your efforts? Your agent is a vital resource in understanding your specific situation—I typically offer guidance to my clients on remodeling efforts that will help sell their home for the best price. Here are a few projects sellers will want to keep off their to-do lists for the best return on investment…

Major, Pricey Upgrades with Long Timelines

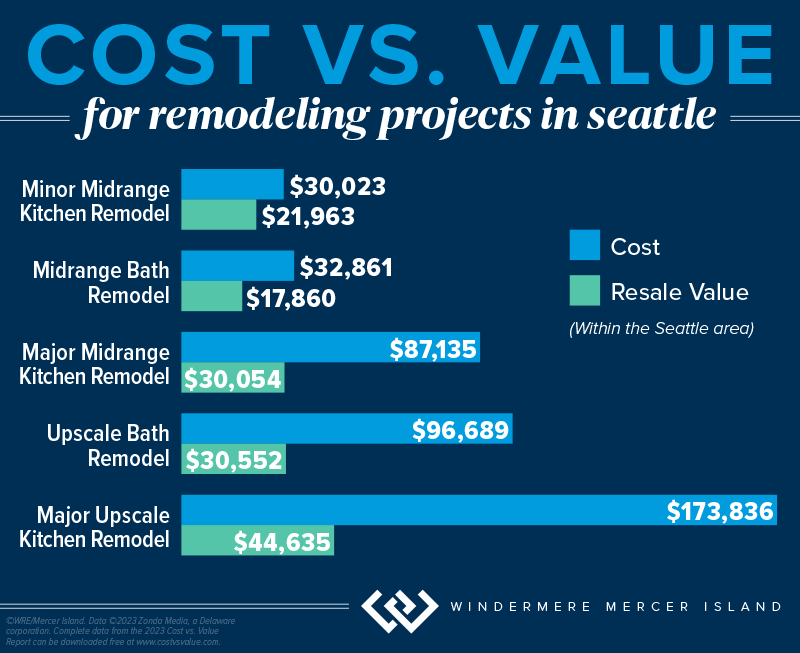

For any remodeling project, an analysis of your home’s value will be key to helping you determine its risk/reward potential (reach out if you’d like one for your home). This dynamic is especially important for big remodels and home upgrades, due to their higher costs. The latest Remodeling Cost vs. Value Report (www.costvsvalue.com)1 data for the Seattle area shows a generally negative return on investment for major, upscale remodeling projects—they only recouped about 25%-30% of their cost…

These projects come with hefty price tags and longer timelines than minor repairs and upgrades, which can complicate factors as you prepare to sell, especially if you have a deadline to get into your new home. They have the potential to temporarily displace you from the property, meaning you and your household may have to find somewhere else to stay until the project is complete.

The Bottom Line: To go through with a major home upgrade before you sell, its schedule must fit with your moving timeline. It should also align with buyer interest in your local market. If the project doesn’t meet these criteria, it should be avoided.

Non-Permitted Projects & Building Code Violations

Before you decide to finish out the basement or make changes to your home’s wiring/structure/mechanical systems, it is important to make sure you obtain the proper city, county and/or state permits + inspections. Non-permitted square footage does not reflect on the county tax record and can lead to low appraisals when the buyer tries to get a loan. Obtaining permits also helps ensure your alterations meet the current building code—otherwise, you may face legal exposure should they create a safety hazard. Furthermore, any non-permitted remodels must be disclosed to the buyer on your Form 17 if you live in Washington State. The buyer’s mortgage lender may also have stipulations saying that the loan may not be used to purchase a home with certain features that aren’t up to code, which could lead to them backing out of the deal.

If you’re selling an older home, you’re not obligated to update every feature that may be out of code to fit modern standards. These projects are often structural and require a significant investment. If the violation in question was built to code according to the regulations at the time, then a grandfather clause typically applies. However, you’ll need to disclose these features to the buyer.

Trendy Makeovers and Upgrades

Lastly, it’s best to avoid remodeling projects that target a specific trend in home design. Trends come and go. Timeless design is a hallmark of marketable homes because it appeals to the widest possible pool of buyers. Keep this in mind when staging your home as well. Creating an environment that’s universally appealing and depersonalized allows buyers to more easily imagine the home as their own.

Wondering which remodeling projects might help your home sell? Reach out any time…I’m never too busy to discuss your options and offer advice based on the current market.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island.

1©2023 Zonda Media, a Delaware corporation. Complete data from the 2023 Cost vs. Value Report can be downloaded free at www.costvsvalue.com.

Adapted from an article that originally appeared on the Windermere Blog, written by: Sandy Dodge.

5 Home Improvements That Will Boost Your Property Value

A home is the largest investment most people will make in their lifetime, so when it comes time to sell, homeowners often wonder what they can do to get the most return on their investment. Many have the misconception that remodeling is the way to go, but that isn’t always the case. Rather than going all-in on upgrading your home, you should know which home improvements are worth it, and which ones aren’t.

We’ve sifted through the research and come up with a quick list of five home improvements that’ll help buyers fall in love with your home when it comes time to sell.

1. Add a little curb appeal

Curb appeal is critical. As the name suggests, it’s the first thing buyers see when pulling up to the front of any home so it needs to be in nearly pristine condition.

Landscaping can go a long way for a minimal upfront investment. Six rounds of fertilizer and weed control will set you back about $415, but when it comes time to sell, you’ll see a return on investment (ROI) of about $900 according to a 2023 survey by the National Association of Realtors.

Other improvements you can easily make to your curb appeal include:

- Pressure wash the exterior

- Liven up your front door with a fresh coat of paint

- Replace hardware such as doorknobs and knockers

- Install updated house numbers

- Make your walkways pop with new greenery or flowers

- Plant a succulent garden

- Update your porch lights

- Add a little charm with window flower boxes

- Stage your porch

2. Convert your HVAC to an electric heat pump

According to the 2023 Cost vs. Value Remodeling Report, replacing an oil or gas furnace with an electric heat pump is one of the hottest trends (and offers an unusually high ROI of 104%). Their earth-friendly efficiency is especially appealing to younger buyers and those concerned about climate change. Additionally, they offer summertime cooling, which is a big bonus in the PNW given our recent hot and smoky summers!

3. Refresh your kitchen

While major kitchen renovations are costly and typically have low ROI, a little elbow grease and modest budget can give you big bang for your buck (see our article on simple kitchen makeover ideas).

Here are some smaller updates to boost your home’s value:

- Clean

- Organize your pantry

- Use a little Murphy Oil Soap and hot water on all of your cabinets

- Polish cabinets with Howard Feed-In-Wax

- Tighten all hinges

- Clean grout and tiles

- Shine your sinks and hardware until you can see your face in it

- Deep clean your stove

- Give your kitchen a fresh coat of neutral paint

- Update lighting fixtures, and replace light bulbs

- Add new and trendy door hardware to your cabinets

- Consider replacing your countertops with a hard surface like quartz or quartzite

- Upgrade your appliances

4. Go green

Today’s younger generations are embracing eco-friendly living, and millennials are leading the pack. According to the National Association of Realtors’ 2022 Home Buyer and Seller Generational Trends Report, millennials make up the largest segment of buyers, holding strong at 43 percent of all buyers.

When it comes to attracting buyers who are willing to pay top dollar, going green makes sense. A Nielson study found that, of more than 30,000 millennials surveyed, 66 percent are willing to shell out more cash for conservation-conscious, sustainable products. Depending on where you live, consider installing solar panels, wind turbines, and eco-friendly water systems.

No matter where you live, attic insulation replacement and weather stripping are safe bets. Attic replacement costs can vary but typically have a good ROI. Weather stripping costs about $350 if you hire a professional, but you can easily DIY for a fraction of that cost.

5. Install hardwood floors

Installing or upgrading hardwood floors is pretty failsafe as most buyers love it. Ninety-nine percent of real estate agents agree that homes with hardwood floors are easier to sell, and 90 percent of agents say that they sell for a higher sale price, according to the National Wood Flooring Association. Similarly, a survey by the National Association of Home Builders (NAHB) found that wood flooring was among the top 10 home features most desired by home buyers.

When it comes time to sell, I will help you get the highest possible ROI for your home. I can connect you with tried-and-true contractors, suggest strategic upgrades, and help you develop the right pricing plan based on up-to-the-minute market analysis. Reach out for a complimentary home value consultation.

© Copyright 2023, Windermere Real Estate/Mercer Island.

Adapted from an article that originally appeared on the Windermere blog November 12, 2018. Written by: Sarah Stilo with HomeLight.

Cost vs. Value data ©2023 Zonda Media, a Delaware corporation. Complete data from the 2023 Cost vs. Value Report can be downloaded free at www.costvsvalue.com.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link